tax saver plans in india

If you are a parent. Lic jeevan anand is the highest selling tax saving plan being sold since more than 2 decades.

Why Equity Linked Saving Schemes Make More Sense Than Regular Equity Funds Businesstoday Issue Date Jul 30 2017

Check best tax saver investments Under 80C for year 2019 Five year Bank FDs ELSS Funds PPF ULIPs NSC NPS Save up to Rs 46800 in Tax.

. LIC Jeevan Anand is the best Tax Saving Plan in India. This plan is best suitable for individuals who have a low-risk appetite and want to save money over a long-term period. 10000 under TTA and Rs.

15 years Public Provident Fund account. Reliance Tax Saver was ranked the third best ELSS scheme by Crisil in December 2016. Invest in House Property for an Additional Tax Saving on interest amount up to Rs2 lakh us 24 b 2Smart Income Tax Saving Tips for Single Income Couple - Parents.

Tax saver mutual fund. Secure investment through diversification of funds. 35 Easy Ways to Save Income Tax in India 202 1 1.

Additionally it has provided decent. One can save their taxes by investing in one or more of the following tax saving plans from simple life insurance to a ULIP plan a pension plan and others. Tax saving instruments and sections therein.

The investors can compare these plans online and get the best savings-investment plans which they need to use as your. ICICI Prudential Value Discovery Fund. If you have a.

In addition we take pride in our ability to. Tax saver plans in india. Axis Long Term Equity.

Franklin India Equity Fund. In this article you will get to know about some of the best LIC tax-saving plans to invest in 2021. Rs100 to rs150 lakh pa.

Long term investment Plan. A tax saving plan is one where an investor has the advantage of claiming benefits on the amount they invested as per prev. Option to choose between 4 Portfolio Strategies.

15 lakh cumulate limit of Section 80C in a financial year. You get a tax deduction up to 15 lakhs under section 80C for FD investment made in a financial year. Compare best saving plans start saving from.

Welcome to TaxSaver Plan. 6 best tax saving sip plans to invest in 2021 updated. Mirae Asset Tax saver fund.

As a tax-saving investments plans the bank FD offers tax-free income. PPF is a great tax saving option as it qualifies for deduction upto Rs 15 Lakhs per annum under section 80C of the Income tax act. Get returns at critical milestones.

Invesco India Tax Plan. Ad SIP in ELSS Fund is a convenient way to build wealth along with tax benefit under Sec 80C. 8 Tax-saving fixed deposits.

LIC offers several tax-saving plans to select from. FD with banks is another good tax saver investment alternative. 8 Tax-saving fixed deposits.

8 Tax-saving fixed deposits. So investments made into a tax saver mutual fund can provide tax deduction benefit of up to Rs. DSP Tax Saver.

You can save tax by investing in tax saver Fixed Deposits which can fetch you tax deduction under section 80C of. Be it JeevanTarun New Childrens Money Back Child Career JeevanLakshya or any other Child Plan each child policy of LIC comes under the best LIC tax saving plans. We are a business that firmly believes in hard work integrity compliance and commitment to customer satisfaction.

Motilal Oswal Long Term Equity Fund. Tax Saver Plans In India.

Best Tax Saving Investments In Fy2020 21 Bajaj Markets

Best Tax Saving Investment Options In 2022 Fy 2022 2023

Income Tax Deductions Exemptions Under Sections 80c 80d 80ddb

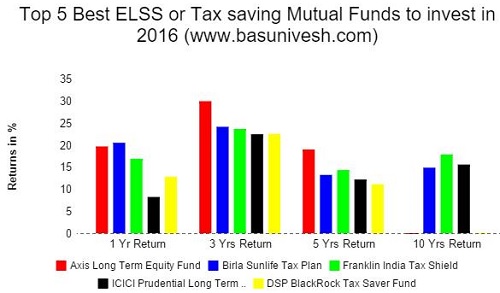

Top 5 Best Elss Or Tax Saving Mutual Funds To Invest In 2016 Basunivesh

5 Myths About Saving Plans In India

Best Elss Mutual Funds To Invest In India 2022

Elss Equity Linked Savings Scheme Features Tax Benefits

Top 10 Income Tax Savings Options Best Tax Saving Options Comparison Ranking Of Top 10 Instruments

Best Investment Options For Tax Savings Investment Plans To Save Tax

Tax Planning Rancho Cucamonga Income Tax Planning Services

Income Tax News Do These Income Tax Saving Products Fit Into Your Financial Plan The Economic Times

Lic Plans Launched In 2017 Should You Invest For Tax Saving

Income Tax Slab Fy 2020 21 Individual Income Tax Tax Levied By Central Government On All Incomes Generated By Individual Budgeting Income Tax Savings Plan

Parag Parikh Tax Saver Vs Mirae Asset Tax Saver Fund Vs Canara Robeco Tax Saver Vs Quant Tax Plan Youtube

17 Best Income Tax Saving Schemes Plans In 2022

Licagenthyderabad Lic Insurance Tax Savings Plans Free Enquiry 9912359818 Hyderabad Life Insurance Quotes Insurance Investments Life Insurance Agent

Cleartax Invest Investment Made Simple

Estate Creation Planning Lic Tax Saving Plans Lic Tax Saving Plans And Benefits Helps The Proposer To Build Corpus For Future Income Tax Limit Under Section 80c Is Limited To

Best Tax Saving Investments Elss Fd Ppf Insurance Under Section 80c